main street small business tax credit 1

The Main Street Small Business Tax Credit II will provide Covid-19 financial relief to qualified small business employers. How to claim File your original or amended income tax return.

How Covid 19 Affects Your Business Taxes Onsite Installer

If your business is eligible for the tax credit you will receive 1000 per net employee hired during July 1 2020 through November 30 2020.

. The credit caps out at 100000 per employer. The Main Street Small Business Tax Credit II provides Covid-19 financial relief to qualified small businesses. What is the Main Street Small Business Tax Credit.

Bloomberg Businessweek helps global leaders stay ahead with insights and in-depth analysis on the people companies events and trends shaping todays complex global economy. The amount is 1000 for each net increase in the qualified employees measured after the monthly full-time. On November 1 2021 the California Department of Tax and Fee.

The Main Street Small Business Tax Credit II will provide Covid-19 financial relief to qualified small business employers. California Assembly Bill No. The total amount of credit available is approximately 116 million and will be allocated on a first-come.

Your Main Street Small Business Tax Credit will be available on April 1 2021. Qualifying businesses may claim the Main Street Small Business Tax Credit for 2021 equal to 1000 for each net increase in qualified employees up to 150000. The small business hiring tax credit provides a credit that a small business employer can use to offset their income taxes or their sales and use taxes when filing their tax returns.

Include your Main Street Small Business Tax Credit FTB 3866 12 form to claim the credit. On November 1 2021 the California Department of Tax and Fee. Apply your credits against your sales and use tax liabilities for reporting periods starting with returns originally.

In order to determine the net. The Main Street Small Business Tax Credit is a relief fund for Californias small businesses to help them get back on their feet and heal the economy. Provide the confirmation number.

Californias governor signed Senate Bill 1447 establishing the Main Street Small Business Tax Credit. On November 1 2021 California will begin accepting applications. Californias government decided to take action to supplement federal relief through the Main Street Small Business Tax Credit.

However You must claim this credit on a timely filed original tax. MainStreet works seamlessly with your CPA. California Main Street Small Business Tax Credit Ii.

This bill provides financial relief to qualified small businesses for the economic. Credit Amount For California Main Street Small Business Tax Credit. The Main Street Small Business Tax Credit II will provide COVID-19 financial relief to qualified small business employers.

50 AB-50 established the California Main Street Small Business Tax Credit II which will provide COVID-19 financial relief to qualified small business employers. Californias governor signed Senate Bill 1447 establishing the Main Street Small Business Tax Credit. This bill provides financial relief to qualified small businesses for the economic.

You can apply for a reservation at 2021 Main Street Small Business Tax Credit II. On or after january 1 2020 and before january 1 2021 a main street small. Californias governor signed Assembly Bill AB 150 establishing the Main Street Small Business Tax Credit II.

Main Street Small Business Tax Credit Available for California Business Owners Beginning on Monday November 1 California Businesses that meet certain qualifying criteria.

Main Street Small Business Tax Credit Available For Cal Businesses

Half Of Small Businesses Operating At A Loss Today Agree Stimulus Checks Would Be Most Helpful Form Of Assistance Score

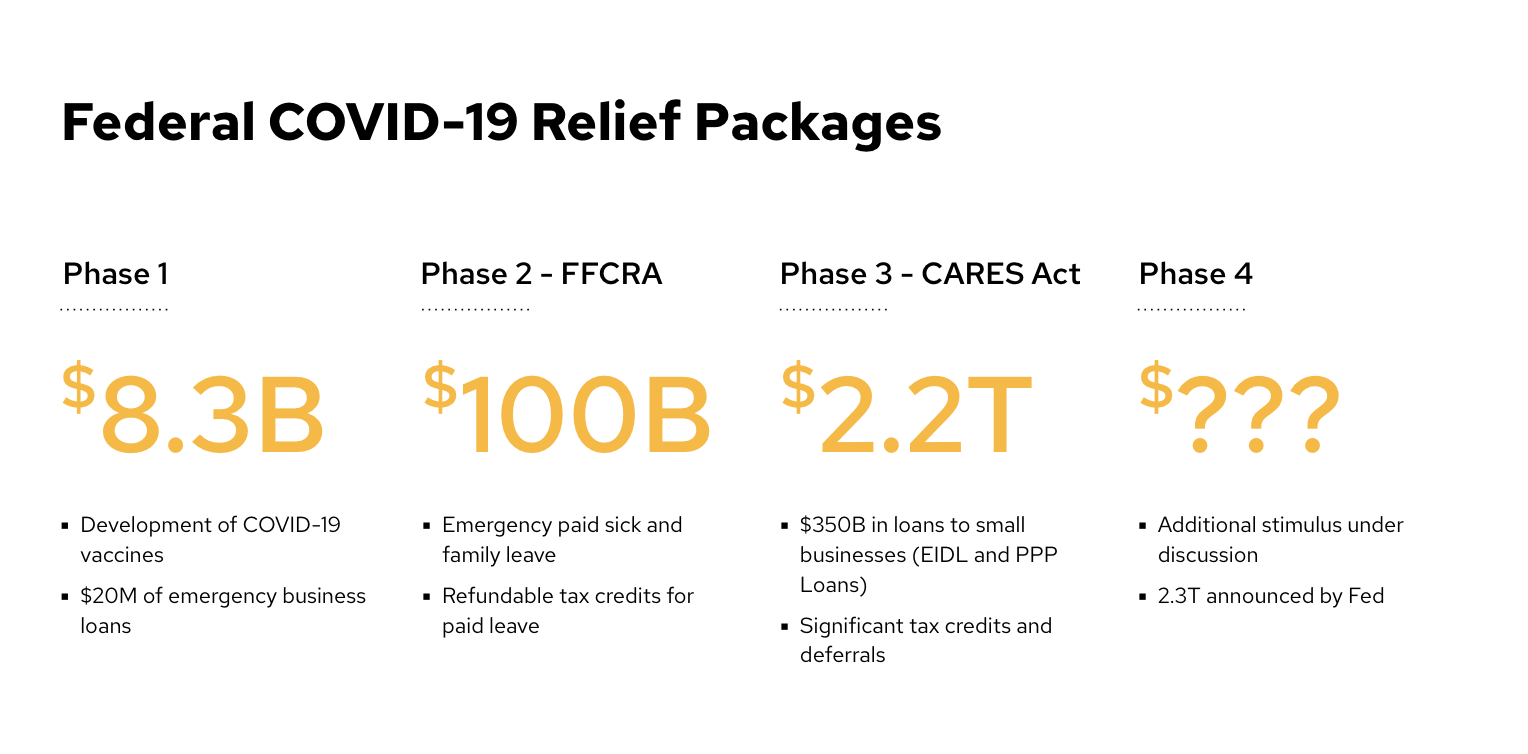

The Small Business Owner S Guide To Federal Aid Rippling

Deduct It Small Business Tax Deduction Guide Legal Books Nolo

Free Business Receipt Template Pdf Word Eforms

Schrader Small Business Letter Main Street Alliance

What Is The Main Street Small Business Tax Credit Tax Hive

Main Street Small Business Tax Credit Incentives Eligibility

Small Business Tax Credits The Complete Guide Nerdwallet

Ca Offers Two Covid 19 Relief Programs San Leandro Next

California Main Street Small Business Credit Ii Kbkg

Small Business Tax Credits The Complete Guide Nerdwallet

Orange County Inland Empire U S Small Business Administration

Announcing The Small Business Billion With Senator Kaplan And The Long Island Main Street Alliance I M In Mineola Standing With Vision Long Island Long Island Main Street Alliance We Re Open

Small Business Tax Credits The Complete Guide Nerdwallet

Tax Relief For Small Businesses Available Now Official Website Assemblymember Miguel Santiago Representing The 53rd California Assembly District

The Main Street Small Business Tax Credit For Small Businesses Launched Last Week Get Started And Learn More At Taxcredit Cdtfa Ca Gov By State Of California Franchise Tax Board Facebook

Main Street Tax Credit Ii More Than 100 Million In The 2021 Main Street Small Business Tax Credit Ii Are Available To Help Qualified Small Business Owners Credits Are First